The 2024 China International Fair for Trade in Services (CIFTIS), co-hosted by the Ministry of Commerce of the People’s Republic of China and the People’s Government of Beijing Municipality, was held in Beijing from September 12th to 16th. Chengdu Financial Week(CDFW) debuted at this year’s fair as Sichuan Province is the guest province of honor for 2024 CIFTIS.

CDFW is named after the Province’s capital city Chengdu and serves as an important international cooperation platform for financial opening as well as building Chengdu into the Western China Financial Centre.

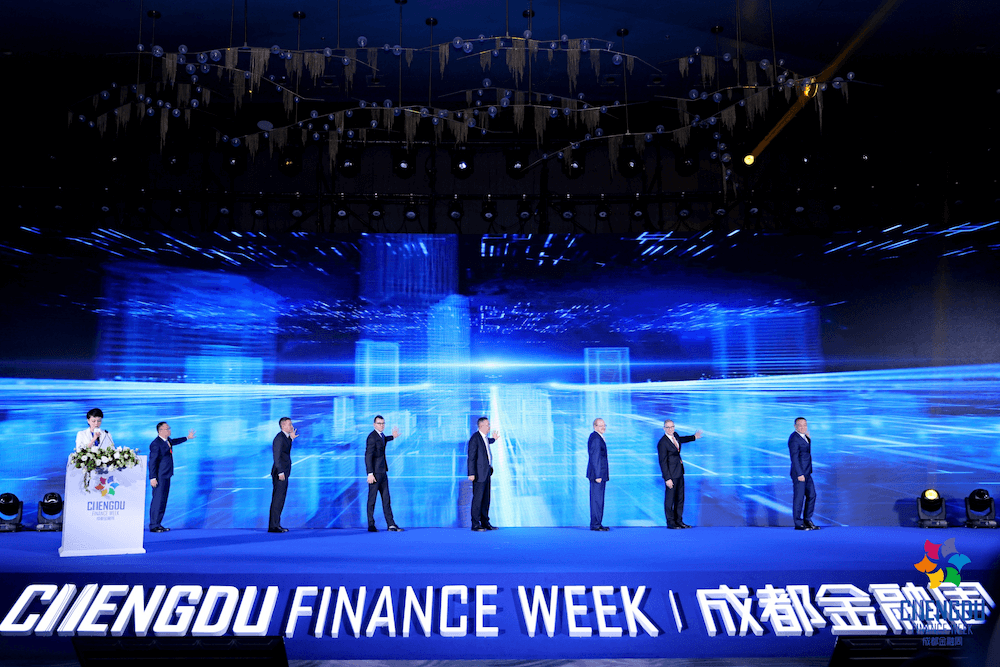

At the “Achievements Release Event” held on September 13th and 14th in the National Convention Center, the CDFW Organizing Committee officially launched this year’s agenda and major achievements, looking for cooperation with global partners.

2024 CDFW, under the theme of “Going Global: Finance Empowers Innovation“, aims to give full play to its role as an innovative cross-border financing empowering platform for Western financial center, promote financial opening in regional and national level, as well as supporting high-quality and innovative overseas industrial financing.

The release event of the Chengdu Finance Week at the China International Fair for Trade in Services (CIFTIS) received strong support from some of the organizing institutions and cooperating units, including the Chengdu Municipal Local Financial Regulation Bureau, China Association for the promotion of development financing, Hong Kong Institute for International Finance, and China Innovation Finance Institute (Chengdu). The Secretariat of the Chengdu Finance Week Organizing Committee, the China Association for the promotion of development financing, the Hong Kong Institute for International Finance, and the China Innovation Finance Institute (Chengdu) signed and exchanged two strategic cooperation agreements. On behalf of the organizers and cooperating parties, the China Innovation Finance Institute (Chengdu) released two flagship reports specially prepared for Chengdu Finance Week’s first participation in CIFTIS: Rise Beyond Wealth:Global Sovereign Wealth Funds and China Market System: Understand and Invest China.

The online audience from multiple partner institutions in Chengdu, Chongqing, Hong Kong, London, Frankfurt, Luxembourg, Zurich, Budapest, Astana, Riyadh, Abu Dhabi, Dubai, Doha, and San Francisco witnessed the one-hour global launch of the 2024 Chengdu Finance Week, the signing of strategic cooperation agreements, and the release of reports.

A representative from the Chengdu Municipal Local Financial Regulation Bureau expressed: “We are pleased that Chengdu Finance Week, as a platform for Chengdu’s financial openness and empowerment, as well as a window for international cooperation, has commenced its work at the 2024 China International Fair for Trade in Services (CIFTIS) and released important outcomes. We look forward to promoting open and mutually beneficial cooperation with global financial centers on a broader, more extensive, and deeper level, exploring interconnectivity between Chengdu and international financial markets, supporting western enterprises in going global, and facilitating international financial institutions to come to Chengdu to operate. Together, we will advance the joint efforts of Chengdu and Chongqing in building the Western China Financial Centre.“

When Fu Chenggang, Chairman of the China Innovation Finance Institute (Chengdu), released the custom report for this year’s CIFTIS—Rise Beyond Wealth: Global Sovereign Wealth Funds—he emphasized that the report provides an in-depth analysis of the development history, functional positioning, country allocation strategies, sectoral investment areas, investment management styles, sustainable investment orientations, and the characteristics of China’s market allocations of major global sovereign wealth funds. The report aims to help the Chinese government, enterprises, and investment management institutions improve the quality of decision-making in cross-border financing and enhance the efficiency of investment and financing.

Fu Chenggang stated that global sovereign wealth funds are currently exhibiting ten major trends:

1.Rapid Expansion of Sovereign Wealth Fund Assets: After a brief downturn during the pandemic, the total assets under management of sovereign wealth funds have surged to a historic high, surpassing $50 trillion.

2.Active Role of Emerging Markets, Especially Middle Eastern Gulf Funds: Sovereign wealth funds from the Middle East Gulf region have been particularly active, investing nearly $100 billion globally in 2023. Through significant capital injections and proactive investments, they have made 2023 the most active investment year for sovereign funds in a decade.

3.Focus on Investment Management Performance: Sovereign wealth funds are leveraging the smallest number of transactions to move the largest amounts of capital, with 60 single deals exceeding $1 billion worldwide. In practice, these funds not only focus on long-term returns but also emphasize short- and medium-term gains.

4.Increased Allocation to Emerging Markets in the Asia-Pacific: While sovereign wealth funds still allocate over 70% of their portfolios to developed markets, they are gradually increasing their investments in emerging markets in the Asia-Pacific, including China, India, Indonesia, Vietnam, and Australia.

5.China’s Growing Influence and Appeal: China continues to attract sovereign wealth fund allocations in both primary equity and secondary stock markets. In particular, China’s tech and innovative enterprises, as well as leading industry champions, are highly favored by Middle Eastern Gulf sovereign wealth funds.

6.Shift Towards Real Estate and Infrastructure Investments: In response to global macroeconomic cycles and geopolitical factors, sovereign wealth funds are allocating half of their portfolios to real estate and infrastructure, reaching a ten-year high. About 20% is allocated to the financial industry, maintaining a stable ratio, while 30% is invested in sectors such as artificial intelligence, healthcare, industrials, consumer goods, and innovation. Some countries especially expect these investments to fuel their domestic economic diversification and sustainable growth.

7.Equities Remain the Largest Allocation: On average, over 40% of sovereign wealth fund assets are allocated to equities. Fixed income accounts for approximately 30%, while private equity, venture capital, real estate, and other alternative assets also make up about 30%.

8.Direct Investment via Internal Teams or Independent Entities: Sovereign wealth funds are increasingly making direct investments through internal departments or wholly-owned independent entities. Another popular strategy is partnering with private equity funds to conduct direct investments through outsourced mandates. For instance, global sovereign wealth funds, including endowments, hold over $600 billion in hedge fund assets, accounting for roughly one-quarter of the industry’s total assets.

9.Support for National Economic Transformation in Emerging Markets: Sovereign wealth funds, particularly in the Middle East Gulf region, are increasingly aligning their investment strategies with their national economic transformation agendas. In addition to mega funds like the Abu Dhabi Investment Authority (ADIA), which allocates assets beyond the Gulf Cooperation Council (GCC) and local UAE markets, there are funds such as Abu Dhabi Developmental Holding Company (ADQ), which fully allocates to domestic industries to support national transformation strategies. Similarly, the Saudi Public Investment Fund (PIF) allocates over 70% of its assets to the domestic market to promote the country’s economic transformation.

10.Embracing Sustainable Development and Transition Finance: Global sovereign wealth funds are actively embracing the sustainability agenda and transition finance frameworks. While adhering to profitability principles, they are adjusting their investment allocation strategies and incorporating high-level sustainable development designs into the governance frameworks of their entire organizations.

According to the Chengdu Finance Week Organizing Committee, “Chengdu Finance Week“ is the first specialized platform in China with the theme of “Finance Week“ aimed at empowering innovative cross-border investment and financing for the Western China Financial Centre. It also serves as a new international cooperation platform that supports Chengdu’s financial development, financial openness, and the overseas expansion of industry and finance. Chengdu Finance Week is characterized by its significant internationalization and innovation, encompassing a diverse range of elements such as strategic collaboration, investment and financing services, platform building, institutional establishment, research and analysis, conferences and forums, and international initiatives.

From its inception, Chengdu Finance Week has been based in Chengdu and the Western China Financial Centre, engaging in deep cooperation with global financial centers. The inaugural Chengdu Finance Week expanded beyond Chengdu to international financial centers such as Beijing, Hong Kong, Frankfurt, Riyadh, Doha, Abu Dhabi, and Astana, where a series of themed forums were held on topics including international financial center development, RMB internationalization, sustainable finance, and sovereign wealth funds. It also hosted several “National Day” and investment and financing roadshow events focused on bilateral economic and financial cooperation with countries such as Luxembourg, Germany, Hungary, Saudi Arabia, and Kazakhstan. Chengdu Finance Week not only brought Chengdu’s outstanding enterprises to the global stage but also invited high-level guests from government departments, international organizations, embassies and consulates, multinational corporations, professional associations, and university think tanks from various countries and regions to each partner city to witness the launch of important cooperation platforms and the signing of agreements. These guests also experienced the functionality of the Belt and Road Financial Service and innovation platforms.

The inaugural Chengdu Finance Week also relied on the Cross-Border Investment and Financing Digital Platform (CIDP) to tailor nearly 100 key visits for Chengdu and Western enterprises, and held international roadshows in several overseas countries, including Saudi Arabia, Qatar, United Arab Emirates, Kazakhstan, and the Kyrgyz Republic. While helping enterprises expand into overseas markets and promoting high-quality development, these events also showcased Chengdu’s leading innovative capabilities and comprehensive financial services under the Belt and Road initiative, thereby enhancing the international influence of both Chengdu and the Western China Financial Centre.

Ms. Guo Mingshe, Vice President and Secretary-General of the China Association for the Promotion of Development Financing stated: “Development finance has played an irreplaceable role in the remarkable achievements of China’s extensive reform and opening-up. As a crucial hub in the urban cluster of Western China and a central node for finance, economy, and industrial influence, Chengdu holds broad reach, covers a large population, exhibits a high degree of openness, and features diverse levels of development. In the construction of the Western China Financial Centre, it is especially critical to fully leverage the incubating function of development finance to transform governmental power into market forces, thereby promoting market institutions and credit development. The China Association for the Promotion of Development Financing co-hosted the inaugural CICA Finance Summit with Chengdu, laying a solid foundation for cooperation. We are delighted to further participate in Chengdu’s financial development and the construction of the Western China Financial Centre through the Chengdu Finance Week. We look forward to showcasing Chengdu’s high-quality financial development and excellent financial environment to the world through the Chengdu Finance Week series of events, enhancing Chengdu’s international financial influence and regional leadership, and utilizing the concepts and practices of development finance with Chinese characteristics to assist Sichuan and Chengdu in achieving further substantial development results.”

Song Min, President of the Hong Kong Institute for International Finance remarked: “We are pleased to have signed a strategic cooperation agreement with the China Innovation Finance Institute (Chengdu). Through the empowerment and cooperation platform of Chengdu Finance Week, we will jointly promote financial, innovation, and economic and trade cooperation between Chengdu and Hong Kong. The development of the Hong Kong International Financial Centre has always emphasized serving the mainland and connecting the world. Chengdu’s urban development, financial services, and industrial economy lead the way in Western China, and its cooperation with Hong Kong has already reached a high level. In the future, we can further deepen collaboration in areas such as capital market financing, overseas expansion of enterprises, and international financial talent development. We look forward to leveraging the ecosystem of Chengdu Finance Week and its empowerment platform to jointly support Chengdu and Western Chinese enterprises in utilizing Hong Kong’s global business landscape.” It is reported that, based on the successful co-hosting of events such as the Global Capital Market Status and Outlook Symposium and the International Financial Center Development Forum, Chengdu Finance Week will further collaborate with the Hong Kong Institute for International Finance and the Institute of Policy and Practice at the Shenzhen Finance Institute on academic and policy research in international finance and cross-border investment, as well as in the development of versatile, international financial talent and social welfare initiatives.

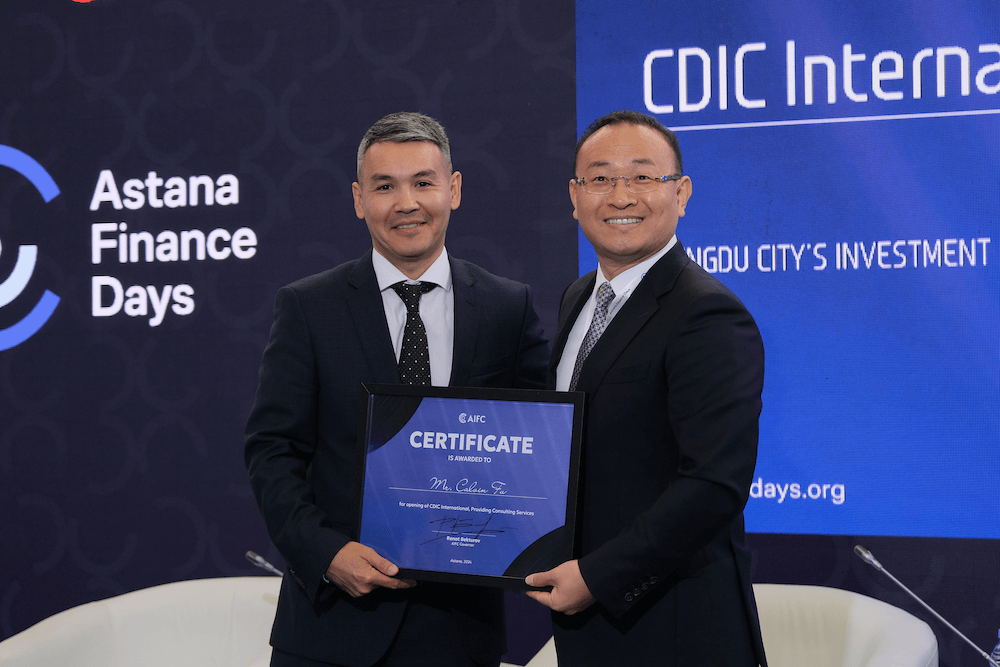

During the same week as the opening of this year’s CIFTIS, at Astana Finance Days, the largest financial forum in Central Asia, Chengdu’s first overseas Financial Investment Office was officially established in Astana, the capital of Kazakhstan, the first country to announce the Belt and Road Initiative. This office is a key component of Chengdu’s two major empowerment platforms: the Cross-Border Investment and Financing Digital Platform (CIDP) and Chengdu Finance Week. At the establishment and licensing ceremony, the China Innovation Finance Institute (Chengdu) introduced Chengdu and the Western China financial development and investment cooperation opportunities to guests from Central Asia and other countries, receiving warm congratulations from the administration and authorities of the Astana International Financial Centre.

At the conclusion of the press conference, Fu Chenggang, Chairman of the China Innovation Finance Institute (Chengdu), stated that the second Chengdu Finance Week will continue to leverage its functions of platform empowerment, financial services, cooperation linkage, investment facilitation, and knowledge creation. It will expand deep cooperation with over 500 government bodies, enterprises, and business associations across more than 20 countries. Through the delivery of practical outcomes and the unique role of the platform, it will promote the financial openness of Chengdu, the joint efforts of Chengdu and Chongqing in building the Western China Financial Centre, and take China’s innovative capabilities to new heights in global markets.